THE ESG REPORTING UNIVERSE IS CHANGING – ARE YOU READY?

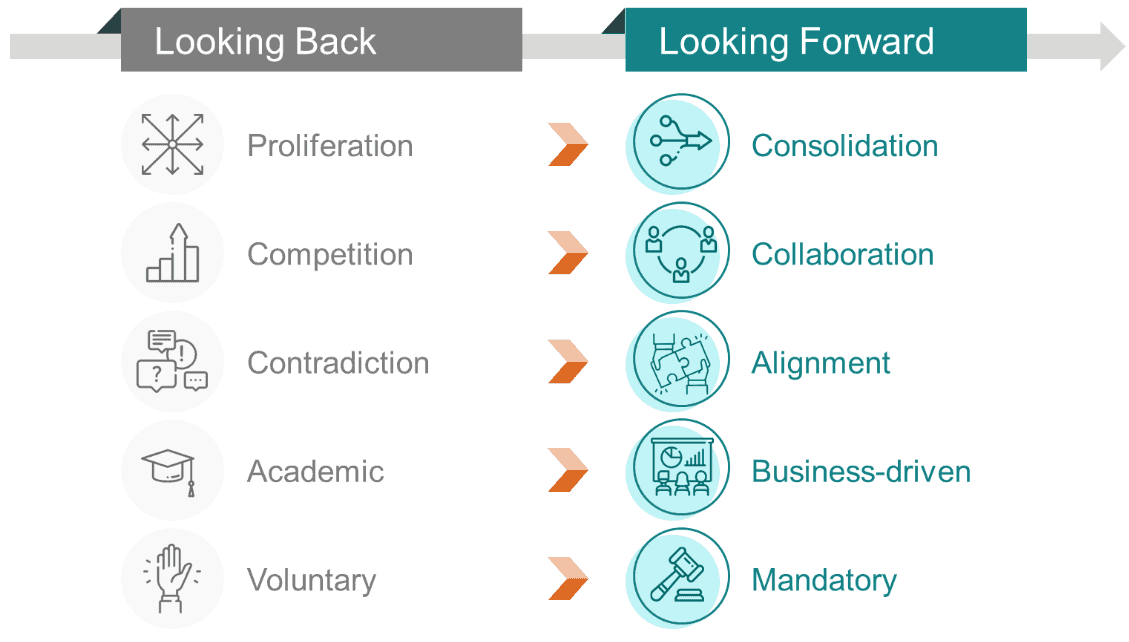

Decades of drawn-out, siloed, redundant, and often misaligned efforts to develop the latest and greatest ESG frameworks and standards have resulted in a mess of conflicting guidance, glorified scores and ratings, irrelevant metrics, wasted resources, unreadable sustainability reports, and – above all – confusion.

At AccountAbility, we always guide our clients through the overwhelming ESG Reporting and Disclosure landscape with four simple rules:

- More disclosure ≠ better disclosure – select the KPIs, metrics, and content that are most relevant to your business and your stakeholders.

- Don’t bite off more than you can chew – anything you report this year will come to be expected with greater scrutiny next year, so plan for the long term and pace yourself

- Clarity is the new eloquence – communicate your story, your performance, and your impact with structure, language, and design that people can connect with and enjoy

- Frameworks and standards are tools, not rules – every framework, standard, guidance, and initiative have a place and a purpose, and should be selected based on your reporting objectives

Companies, globally, have responded with a greater understanding of the sustainability issues that impact their business and more consistent ESG reporting:

- 96% of G250 companies now report on sustainability or ESG matters

- 64% of the G250 acknowledge climate change as a risk to their business and 49% acknowledge the risk of social elements

- 71% of N100 companies identify material ESG topics

- The Task Force on Climate-Related Financial Disclosure (TCFD) adoption nearly doubled from 37% to 61% in the last 2 years

Now, as regulators, investors, board members, executive leaders, consumers, and employees become more familiar and demanding when it comes to ESG performance, the fog is fading, and the landscape is evolving.

- Mandatory reporting is becoming the new normal: The EU's Corporate Sustainability Reporting Directive (CSRD), due to take force in 2024, will enshrine the principle of double materiality in ESG reporting. In the US, the SEC rule on disclosure of climate-related information is expected to be approved in late 2022 or early 2023.

- ESG standards and frameworks, including GRI, CDP, TCFD, and others, are "signing on" to the International Sustainability Standards Board (ISSB), signaling a move towards consolidation in the standards space

- 67 of the world's stock exchanges now issue ESG guidance for listed companies according to the UN Sustainable Stock Exchanges Initiative

- 95% of global credit rating agencies now take ESG factors into consideration

The Future of ESG Reporting is becoming clearer.

The road ahead is becoming clearer, but the pace of change can be dizzying. We are here to help.

AccountAbility has authored some of the earliest and most widely used sustainability standards, even before the term ESG was coined, and we have been advising clients, globally, on their ESG Strategy, Governance, Implementation, Reporting and Disclosure practices for nearly three decades. Our focus on clarity, relevance, and practicality has enabled clients to effectively communicate their Sustainability Story, disclose metrics of value, and engage stakeholders on issues that matter. It has also won us a few awards along the way...

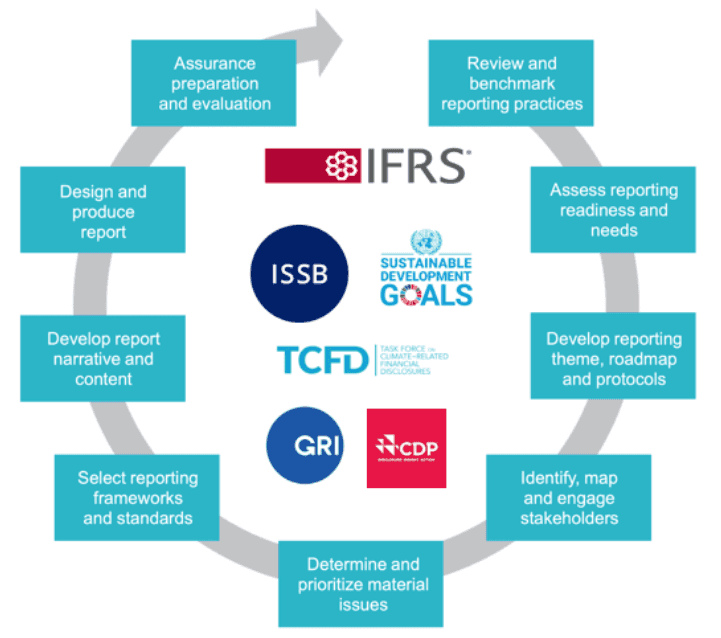

ACCOUNTABILITY SUPPORTS THE FULL ESG REPORTING AND DISCLOSURE CYCLE

Email us at ESGreporting@accountability.org to connect with a team member and learn more about how we can help your organization navigate the rapidly changing ESG landscape this reporting season.